Idea

ASEAN stepping up its green and digital transition

One illustration of ASEAN’s growing geopolitical importance is the agreement signed in August last year by Viet Nam and the United States of America to develop the manufacturing of semiconductors in Viet Nam. This agreement includes training in electronics and other Industry 4.0 fields, as well as joint research in climate science, conservation, biotechnology, health and other areas.

Semiconductors are strategic technologies. They regulate the flow of electric current in electronic devices, making them a fundamental component of microchips commonly employed in devices such as computers and smartphones.

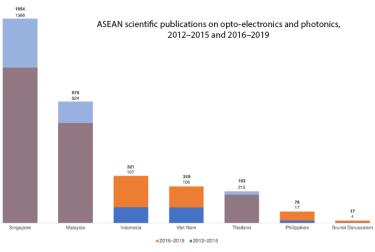

Opto-electronics and photonics, which focus on the study of light, are contributing to progress in semiconductors and various other innovative technologies. Fibre-optic cables transmit data through rapid pulses of light and LED tubes and bulbs provide energy-efficient lighting. Sensors are capable of detecting obstacles. Together with computers equipped with machine vision, these ‘smart’ technologies play crucial roles in automating diverse systems, including autonomous vehicles, advanced robotics and facial recognition software.

Opto-electronics and photonics are science-based industries. This means that many next-generation technologies will emerge from the laboratories of universities. That makes it extremely important for countries to have a strong capacity in both basic and applied research.

Most ASEAN countries have a relatively high ratio of university graduates in engineering and information and communication technologies (ICTs) but a lower proportion of science graduates. In Viet Nam, less than 1% of students graduate in the natural sciences, compared to 20% in engineering. Even in Malaysia, the most scientifically advanced ASEAN country after Singapore, less than 4% of students graduate in natural sciences, compared to 29% in engineering.

Research spending levels show greater convergence

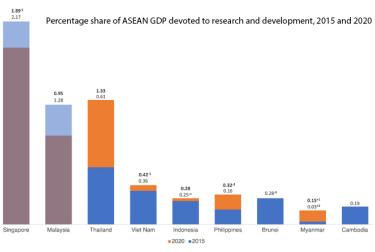

Malaysia devotes 0.95% of its GDP to research and development (R&D), almost five times more than Viet Nam, but this is down from 1.28% of GDP in 2015. After axing key research funds, the Malaysian government reversed course in 2021 by creating the Grand Challenge, which allocates funds to disruptive start-ups and small and medium-sized enterprises. Most research in Malaysia is conducted by universities but these often lack ties to industry, holding back innovation.

Research intensity is also down in the ASEAN region’s most research-intensive country, Singapore; it devoted 1.89% of GDP to R&D in 2019, down from 2.17% in 2015. Singapore’s research intensity has followed a similar trajectory to that of Australia, which spent 2.18% of GDP on R&D in 2013 but only 1.83% in 2019.

The Philippines has doubled it research intensity to 0.32% of GDP but it is Thailand that has experienced the fastest growth in research spending among ASEAN countries. A decade ago, Thailand was devoting about 0.4% of GDP to R&D. That share has since risen to 1.33% of GDP.

Thai firms are now entitled to a 300% tax rebate on their research spending. There are more start-ups than in the past, which don’t tend to specialize in high-tech fields. Thailand has set up an Eastern Economic Corridor for Innovation to make it easier for research institutes and universities to transfer technology to companies specializing in the ten high-tech sectors of the Thailand 4.0 strategy adopted in 2016. These sectors are: electric vehicles; smart electronics; medical tourism; agriculture; biotechnology and food; robotics for industry; logistics and aviation; biofuels and biochemicals; digital medical services; education; and defence.

Stronger output in digital technologies

Vietnamese output in opto-electronics and photonics is modest but growing; scientists produced 249 publications on this topic between 2016 and 2019, more than double the number over the previous four-year period.

However, the fastest growth among ASEAN countries has been observed in Indonesia, which tripled its output on opto-electronics and photonics to 321 publications over the dual four-year periods, and in the Philippines, which boosted its own output by a factor of four to 78. Scientific output in this field actually dropped slightly in the leading countries of Singapore and Malaysia, as well as in Thailand. The drop in Singapore can be explained by the fact that the electronics industry is now a lesser priority for this country than the biopharmaceutical sector.

The surge in Indonesian output can be linked to the government’s introduction of a system in 2017 which ranks scientists according to the volume of their publications in Scopus-indexed journals – the very database used by the UNESCO Science Report. This ranking system is part of a wider set of assessment criteria that are influencing the award of grants, promotions and financial incentives in the Indonesian research community.

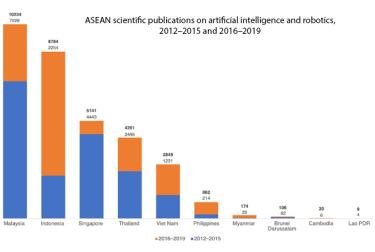

Artificial intelligence: another science-based industry

Artificial intelligence is another strategic research field at global level. It also happens to be a science-based industry. It can be coupled with robotics, a hybrid field linking deep science with digital technologies.

In line with global trends, ASEAN scientists are publishing much more on artificial intelligence and robotics than in the field of opto-electronics and photonics. Moreover, all ASEAN countries have shown growth in this field (see figure).

Malaysia and Viet Nam have adopted national strategies for artificial intelligence and, as we saw above, Thailand has set up an Eastern Economic Corridor for Innovation where research institutes and universities can transfer technology to companies in fields that include automation, robotics and intelligent systems.

Helping companies to digitalize

Given the fast pace with which digital technologies are developing, small and medium-sized companies are struggling to keep up. The digitalization of existing industries remains a challenge in ASEAN – but also for the most advanced countries.

For instance, the European Commission estimates that only about one in five European companies had digitalized their business processes by 2020; it has introduced digital innovation hubs to allow companies of all sizes to ‘test before they invest’ in digital technologies.

Australia’s Industry 4.0 strategy, Tech Future (2018), proposes establishing ‘test labs’ at five universities to help manufacturers transition to ‘smart’ factories that use cyber-physical systems such as robots.

ASEAN countries are, themselves, putting various measures in place to help companies remain competitive. Malaysia is offering firms in the services sector a Smart Automation Grant to help them digitalize their business processes, as part of the National Policy on Industry 4.0. Companies pay at least half of the total cost of their digitalization project. In parallel, Malaysia’s Smart Manufacturing Experience Centre gives companies access to platforms where they can trial their invention.

In the Philippines, the SETUP 4.0 scheme is offering loans to micro-enterprises and small companies (of up to PHP 5 million, circa US$ 100 000) to help them innovate in areas related to the ongoing Fourth Industrial Revolution.

Thailand is developing ‘smart’ Innovation districts. The National Innovation Agency provides funds to allow start-ups to test their unproven ideas and technologies to see which ones respond to local needs.

The challenge of greening the digital revolution

Ensuring that the digital transition is also a green transition remains a daunting challenge, as underscored by a 2022 report by the European Commission (1). For instance, the report estimates that digital technologies currently account for 5–9% of global electricity use but observes that energy consumption could rise unless digital technologies become more energy-efficient.

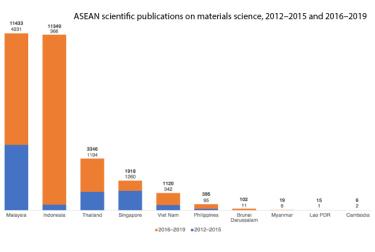

Greater use of digital technologies could increase electronic waste to 75 million tonnes by 2030. Digitalization is also expected to increase water usage; water is already being used to cool data centres and in microchip manufacturing. Growing demand for batteries for autonomous cars, solar panels and wind turbines raises the risk of overdemand for minerals leading to supply shortages in the coming decades. This looming crisis is one reason why materials science has become such an important field of global research. All ASEAN countries have shown strong growth in this field (see figure).

The digital transition can also help drive the green transition. For instance, sensors have the potential to increase the efficiency of energy and materials, the European Commission’s report observes, such as through automatic lighting systems in homes and offices that are triggered by movement. Smart meters can forecast supply and demand for energy. Solar panels and wind turbines can ‘green’ the energy consumption by data centres and cloud infrastructure.

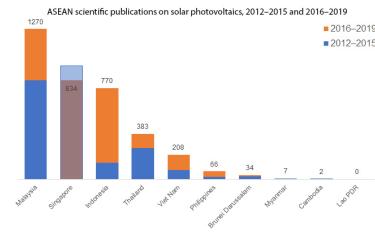

Among ASEAN countries, it is Malaysia which is publishing the most research on solar photovoltaics (see figure). According to the UNESCO Science Report, Malaysia has fixed itself the target of generating 20% of its electricity from renewable sources of energy by 2025. The country has raised its share of global research on solar photovoltaics from 1.7% (2012–2015) to 2.2% (2016–2019).

This is in keeping with global trends. The share of output on photovoltaics by scientists in high-income countries shrank from 75% to 50% over the eight years to 2019, according to the UNESCO Science Report.

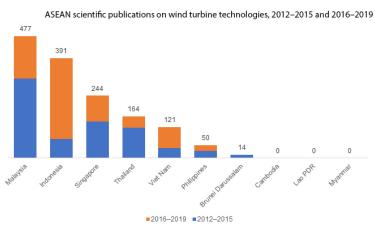

ASEAN output on wind turbine technology has been much lower than that on solar photovoltaics (see figure).

Smart ASEAN cities

Several ASEAN countries are developing smart cities through public–private partnerships, according to the UNESCO Science Report. For instance, 80% of housing in Singapore is public housing. The Housing and Development Board is equipping homes and the city with sensors and other technology to provide efficient services and reduce waste. It is developing smart buses with computer-generated routes, through a partnership with the company Beeline. The city is also developing smart wastewater treatment.

The Philippines’ New Clark City is taking a similar approach. It is developing driverless public transport and an efficient wastewater system. The city is also being built inland with wide drainage to withstand flooding and includes no-build zones in floodplains.

Smart transport systems and wastewater management systems are being introduced into these smart cities. But how much research are ASEAN countries conducting on these topics?

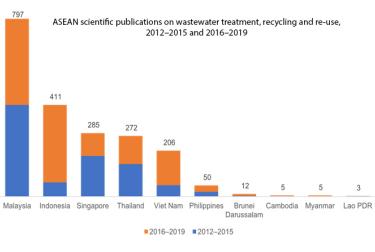

Here again, it is Malaysia which is publishing the most on the topic of wastewater management (see figure). It even raised its world share of scientific publications from 2.1% to 2.7% over the dual four-year periods. However, Indonesia, Singapore, Thailand, Viet Nam and the Philippines have all increased their scientific output on this topic too, with Indonesia showing the strongest growth.

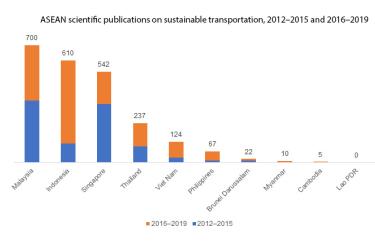

ASEAN output on the topic of sustainable transportation paints a similar picture. Again, Malaysia leads the table (see figure).

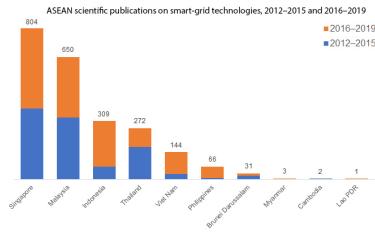

As for scientific publishing by ASEAN countries on smart-grid technologies, here, Singapore leads the table. Despite growth, Singapore’s share of global publications on this topic has actually dropped from to 2.0% to 1.5%, owing to the growing prioritizing at global level of research into smart-grid technologies.

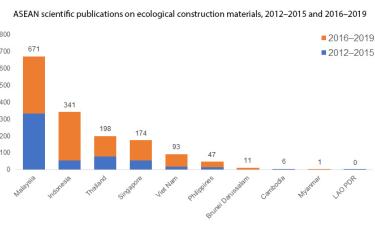

Cement-making is a strong driver of carbon emissions and consumes vast amounts of sand and gravel, the most traded resources after water. The depletion of sand from beaches to make cement could harm tourism in tropical countries like the ASEAN members. Cement-making has another drawback: it is an energy-intensive process. Finding more ecological construction materials should, thus, be a priority of sustainability science. Among ASEAN countries, Malaysia leads the table for this field of research; it has boosted its global share of publications on this topic from 2.5% to 3.5% over the dual four-year periods under study.

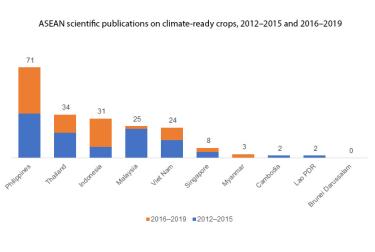

With two-thirds of the global population expected to live in towns and cities by 2050 – be they smart or not –, peri-urban agriculture based on agro-ecology and climate-ready crops will be vital components of urban food security. On the vital topic of climate-ready crops, it is the Philippines which takes the lead for scientific publishing, thanks to the role played by the International Rice Research Institute based in Los Baños and by the Philippine Rice Research Institute. Although the number of scientific publications on climate-ready crops produced by the Philippines is modest, this reflects the generally low priority accorded to this research topic worldwide, since it accounted for just 0.02% of all scientific articles published between 2012 and 2019. The Philippines, Thailand and Indonesia and Vietnam all show strong growth on this research topic (see figure).

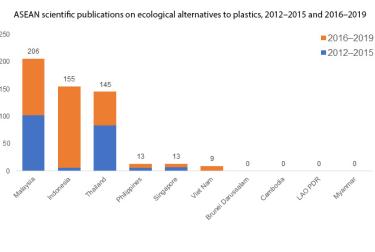

Another ‘green’ research topic showing strong growth is tackling the massive problem of plastic pollution. Malaysia, Indonesia, Thailand and Viet Nam have all shown strong growth in research into ecological alternatives to plastic. After China decided in 2017 to stop importing low-quality plastic waste, much of this waste was re-oriented towards the ASEAN region. As a consequence, researchers in countries affected by growing volumes of plastic pollution have stepped up their research into ecological alternatives to plastics (see figure).

On this research topic, Malaysia showed the greatest output among ASEAN countries and the world’s fifth-greatest output by volume (ex aequo with Brazil). Malaysia has instigated a campaign to eliminate use of plastics and support the recycling of biowaste. In parallel, it has increased its global share of research on ecological alternatives to plastics from 5.1% to 6.3% over the dual four-year periods, ahead of Indonesia and Thailand, which came 8th and 9th worldwide for volume, respectively. Indonesia’s scientific output on this topic surged from 6 to 155 publications over the dual four-year periods and Thailand published no less than nine times the average global proportion of papers on this topic.

Trade winds blowing towards green industries

ASEAN member states formed an official Economic Community in 2015. All ten countries are also members of the Regional Comprehensive Economic Partnership launched in November 2020, which also groups Australia, China, Japan, the Republic of Korea and New Zealand. One of the world’s largest free-trade deals, since it represents about 30% of the global population and GDP, the Partnership provides for the elimination of tariffs on about 65% of goods traded within the region. The UNESCO Science Report observes that it makes no provision, however, for unified labour and environmental standards.

In October 2023, the European Union’s Carbon Border Adjustment Mechanism became operational. This mechanism is the bloc’s answer to the tricky question of how governments can hold domestic industry to higher environmental standards than their foreign competitors without undermining the competitiveness of their own industries.

The mechanism seeks to incentivize non-EU countries (third countries) like ASEAN member states to export products with a low carbon footprint to the EU and, secondly, to buffer the competitivity of European companies that commit to decarbonization by making carbon-rich imports pay higher customs duties and/or tariffs.

Current imports affected by this mechanism include cement, iron and steel, aluminum, fertilizers and electricity, with the possibility that hydrogen, organic chemicals and polymers like plastics will be added to the list later.

The Carbon Border Adjustment Mechanism is aligned with the World Trade Organization. Both China and Japan are contemplating the idea of introducing their own carbon border adjustment mechanism, as is Canada.

This article is based on a presentation by Susan Schneegans, Editor-in-Chief of the UNESCO Science Report (2021), to the Philippine Institute of Development Studies at its Annual Public Policy Conference held in Manila on 19 September 2023.

(1) Source: European Commission (2022) Strategic Foresight Report: Twinning the Green and Digital Transitions in the New Geopolitical Context